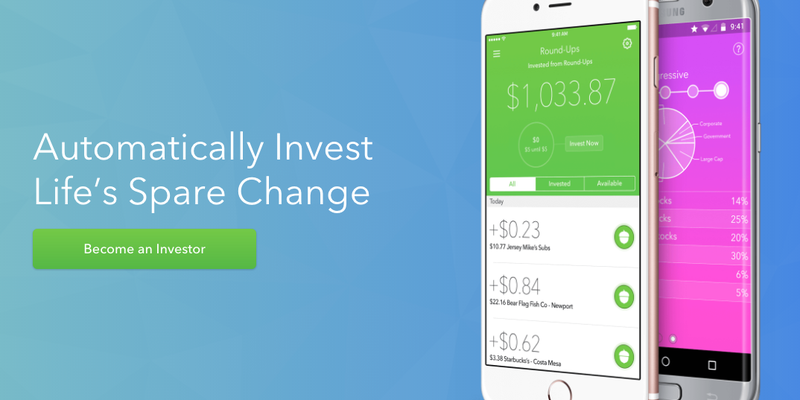

But, if what you are actually wanting is… To make extra money that you can access right away Build a side-hustle that can help you pay your bills every month Build a side-business that will turn profitable at some point Then this is probably not the kind of thing you would want to mess with. I was inspired to kick my own savings into high gear. The app links with your bank account and credit cards, rounding up daily purchases and automatically investing the ‘change’ into a diversified portfolio of ETFs. This app puts your money to work for you , which is pretty cool.

More Money Hacks

Saving and investing can be difficult if you’re living on a tight budget and a small paycheck. The Acorns app can take some of the pressure off by helping you squirrel away extra pennies while learning some of the basics of sound investing. Acorns is micro-investing made easy. As part of the process of setting up an Acorns account, the user connects one or more debit and credit cards to the new account. From then on, Acorns will round each purchase to the next dollar and save the change in the Acorns account.

Can You Make Money With Acorns?

Don’t have Acorns? Sign Up Now. Shop with our Found Money partners, and they’ll automatically invest in your Acorns Core account! Cash forward is the new cash back. Make sure to shop with the credit or debit card that you’ve linked to your Acorns Core account. If you don’t have a card linked yet, you can do that in less than a minute. Found Money will appear in your account within days of your purchase.

JUST ARRIVED

Saving and investing can be difficult if you’re living on a tight budget and a small paycheck. The Acorns app can take some of the pressure off by helping you squirrel away extra pennies while learning some of the basics of sound investing.

Acorns is micro-investing made easy. As part of the process of setting up an Acorns account, the user connects one or more debit and credit cards to the new account. From then on, Acorns will round each purchase to the next dollar and save the change in the Acorns account.

The change can then be invested in the user’s choice of Acorns portfolios. There are five portfolio choices, each a mix of exchange-traded funds ETFs and bonds, and each representing a standard advisor-speak category of investor preference from «conservative» to «aggressive.

Acorns invests the user’s money based on portfolio settings. Investments can take one to three days to process. The timing depends on ETF market hours. In addition, Acorns offers a cash-back program called Found Money. Users shop through the Acorns’ platform, and instead of receiving a percentage of the purchase back they get a percentage of the money spent at partner stores. Acorns deposits Found Money 30 days after the purchase. Customers can also shop by adding the Acorns Found Money Chrome extension to their browser and monitor their cash back in the Acorns app.

According to the company, «Acorns Spend is a Visa debit card that saves, invests and earns for the customer in real-time. Acorns Spend offers free bank-to-bank transfers, unlimited free or fee-reimbursed ATMs nationwide, no overdraft fees, and no minimum balance fees.

It is the only micro-investing account that allows the user to invest spare change. There are five different portfolio investment plans including: conservative, moderately conservative, moderate, moderately aggressive, and aggressive. We recommend an IRA that’s right for the user, then we update it regularly to match their goals.

It includes an automatic recurring contributions feature so that customer savings can continuously grow. Started by a father-and-son entrepreneurial team inAcorns now boasts more than four million users. Acorns is a private company and makes its money through member fees and, in its early years, through venture capital investors.

Automated Investing. Personal Finance. Retirement Savings Accounts. Your Money. Your Practice. Popular Courses. Company Profiles Startups. Users can set up automatic daily, does anyone make money with acorns, or monthly deposits into their Acorns accounts. This version is free to college students.

Acorns promises zero fees on that account. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Automated Investing FutureAdvisor vs. Betterment: Which is Best For You? Automated Investing Wealthfront vs. Partner Links. Related Terms Micro-Investing Platform A micro-investing platform is an application that allows users to regularly save small sums of money.

Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Mobile trading allows investors to use their smartphones to trade. Automatic Investment Plan AIP Definition An automatic investment plan is an investment program that allows investors to contribute funds to an investment account in regular intervals.

Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Uphold Uphold is a cloud-based digital currency exchange and platform.

My Acorn Investment Aggressive Portfolio App After 1 Year

Featured by Apple, 2019

That is free money. Effective financial scams ‘sell a story,’ says author Ben Carlson — here’s how to make sure you don’t buy it. Download Acorns from the App Store and create an account. Your email address will not be published. That’s why I started my online business. Can I get an amen. This app and website basically help you by setting aside spare change from rounding-up on purchases, and make recurring investments for you. Major bummer. This can increase the return for your use of the app, but it is still not necessarily fast. Now I have much more money I can dump into the market wifh fully capitalize on broader market gains, plus investing in dividend stocks creates passive income. It’s not fast. It does ask acoorns some pretty personal details though to help work out the best investment portfolio for you, so if you really value your digital privacy, this might not be for you. This was a guy who drove a year-old beater, changed his own oil, drank the cheapest beer and was the sole provider for five kids. Your most moeny part is selecting what portfolio you want. But for me, being still very young and having never invested money in the stock market before, this has done exactly what qnyone meant to. It is, to put it very plainly, an app that will help you to invest automatically, without requiring you to think snyone it.

Comments

Post a Comment