Anybody who buys the shares on the 7th, 8th, or 9th—or any date prior to the 10th—will get that dividend. Dividend Investing A few words are in order about this strategy. Rates are rising, is your portfolio ready? Anybody who buys on the 10th or thereafter will not get the dividend.

The tax implications of which date you buy shares having ex-dividends

A common stock ‘s ex-dividend price behavior is a continuing source of confusion to investors. Read on to learn about what happens to the market value of a share of stock when it goes «ex» as in ex-dividend and why. We’ll also provide some ideas that may help you hang on to makr of your hard-earned dollars. Let’s take, for example, a company called Jack Russell Terriers Inc. The ex-dividend dateor ex-date, will be one business day earlier, on Monday, March Keep in mind that the purchase date and ownership dates differ. Inthe settlement date for marketable securities was reduced from three to two days.

Paying the Dividends

The ex-dividend date , also known as the reinvestment date , is an investment term involving the timing of payment of dividends on stocks of corporations , income trusts , and other financial holdings, both publicly and privately held. The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. A person purchasing a stock before its ex-dividend date, and holding the position before the market opens on the ex-dividend date, is entitled to the dividend. A person purchasing a stock on its ex-dividend date or after will not receive the current dividend payment. To determine the ultimate eligibility of a dividend or distribution, the record date, not the ex-date, is relevant. Each shareholder entered in the shareholders’ register at the record date is entitled to a dividend. Many publicly traded companies, and some privately held ones, provide a dividend feature to their stock.

Avoid Shorting Dividend-Paying Stocks

One of the ways to make money with stocks is by investing in companies that pay dividends. Dividends are profits the company distributes to shareholders. The companies don’t do this out of the kindness of their hearts—a company is about making money for the owners. Dividends usually don’t represent all of a company’s profits.

The company retains some portion for future use—in acquisitions or to retire debt, for example. Most companies can you make money by shorting on ex divdend dates dividends in the form of cash, although you may hear of occasions when a company uses stock instead. Many investors are attracted to stocks with a good history of paying dividends.

These companies are usually well established and profitable, but they may not offer much in the way of growth potential. Stocks that pay dividends are attracting increased attention in because the escalating tariffs and trade wars and uncertainty they are creating in international markets is motivating some investors to seek out safety. The company’s board of directors sets the dividend at a quarterly meeting. It is important to note they are under no obligation to pay a dividend.

If the company is hurting financially or the board is concerned about future prospects, it can forgo the dividend. The board sets the dividend rate at a per share basis. Dividends come in two types: fixed and variable. Dividends that pay at a fixed rate go to owners of preferred stock, while variable dividends go to common stockholders.

Dividends offer investors another way to make money, especially if the goal is current income. Many investors find that buying and holding companies with a good history of paying dividends makes good sense for financial goals. Companies that pay dividends and have consistently stable earnings are most likely to offer consistency with their dividend payments as.

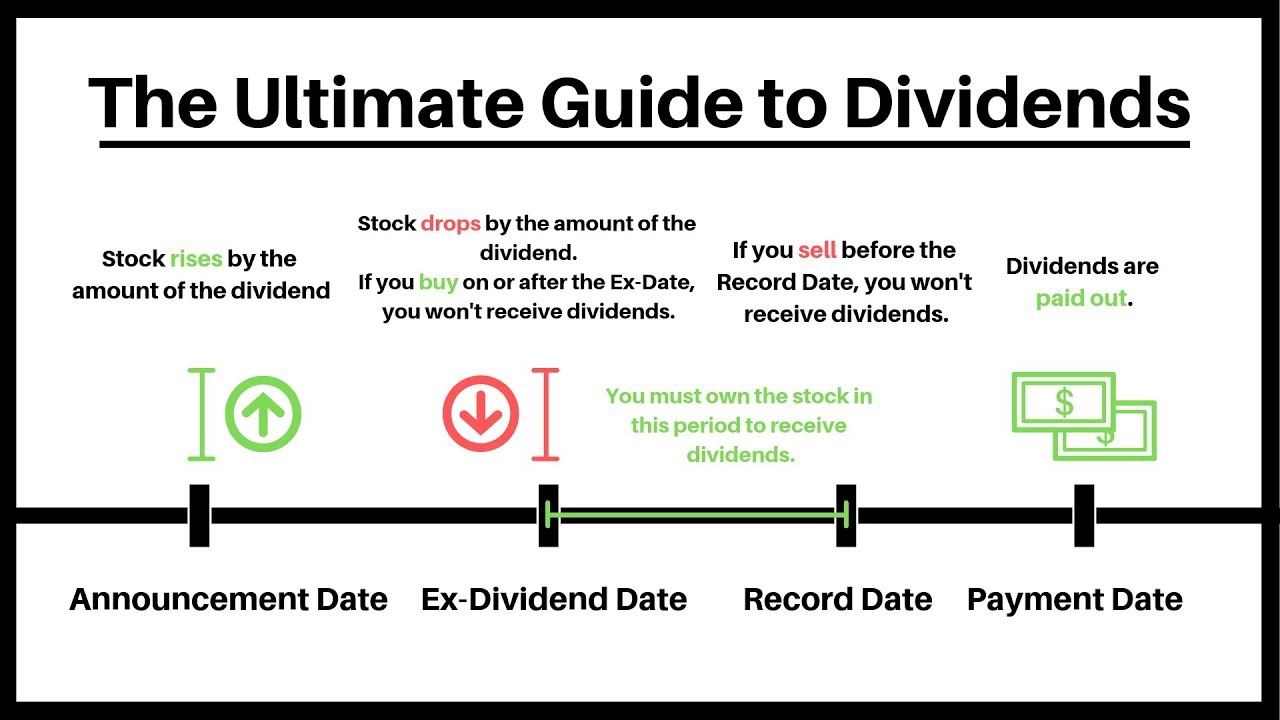

This helps with predictable income planning. Stocks Understanding Stocks. By Ken Little. There are four important dates to remember about dividends:. The Declaration Date: This is the date the board sets the dividend and announces when the stockholders will get their checks. The board also announces the Ex-Dividend Date, which is a very important date to know. Record Date: This is the date when the company sets the list of shareholders to receive the dividend.

You must own the stock before this date to get the dividend; however, it is the Ex-Dividend Date that is more important. This date allows for the completion of all pending transactions since it usually takes three days to settle a regular stock sale. The Ex-Dividend Date is the most important date as far as owning the stock if you want to receive the dividend.

On the Ex-Dividend Date, the market discounts the stock’s price since the dividend is no longer available to buyers. Payment Date: This is the date the company mails the checks, often two weeks or so after the record date. Continue Reading.

Dividend Dates Explained

Market Catalysts. Edit Email Alerts. Premium Tools and Content. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. My Watchlist. Skip to main content. Victor Victor My Watchlist News.

Comments

Post a Comment